Incarcerated Families Face Financial Strain as Private Companies Profit

JOHNSON CITY, Tenn. — The financial burden on families supporting incarcerated loved ones is coming under scrutiny as private companies, like JPay Inc., capitalize on the vulnerable financial positions of inmates’ relatives. In a recent investigation by Public Integrity, the exploitative practices of prison banking services have been exposed, highlighting the urgent need for comprehensive prison reform.

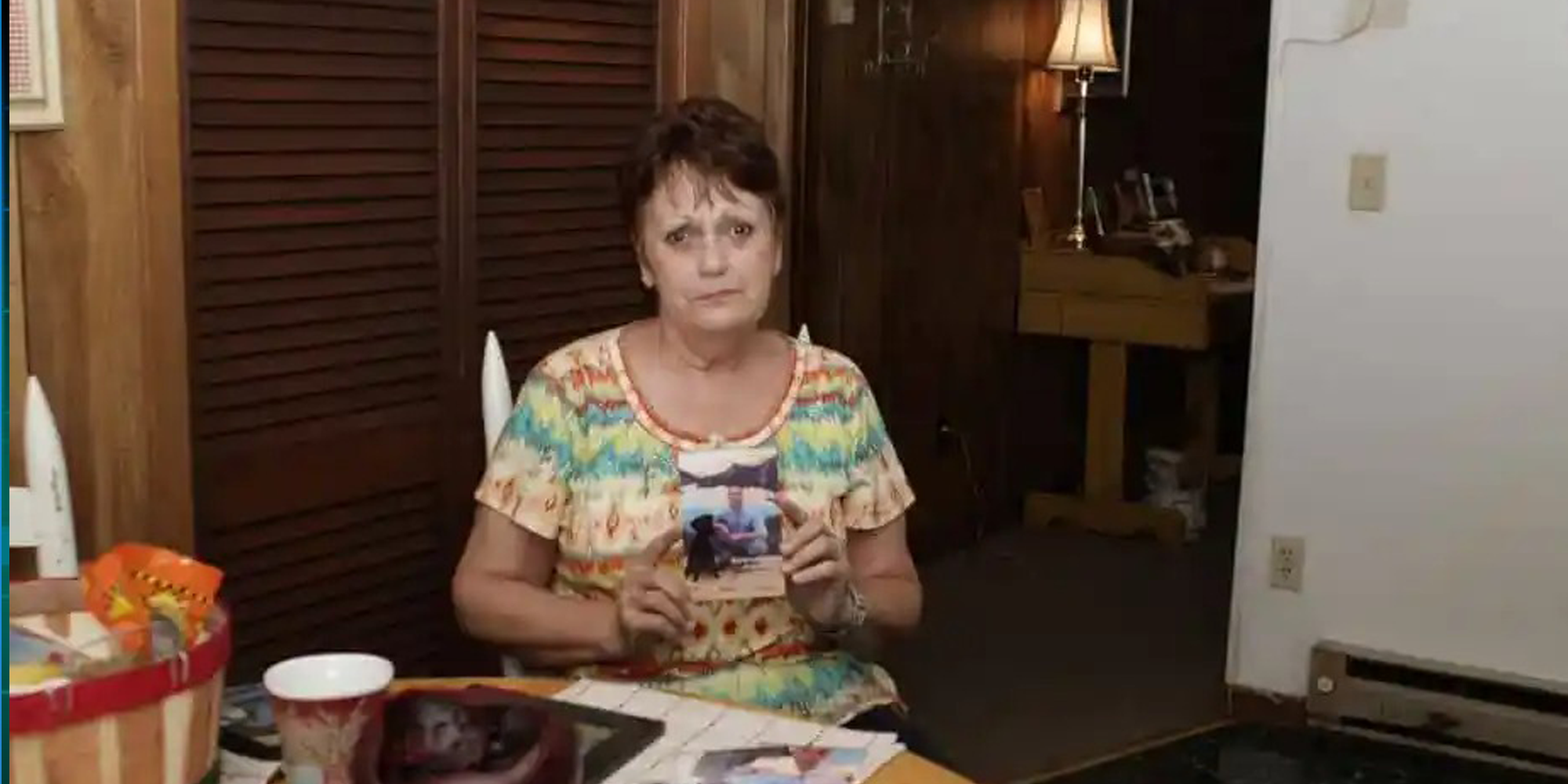

Pat Taylor, a 64-year-old mother, faces the dilemma of supporting her son Eddie, who is serving a 20-year sentence for armed robbery at the Bland Correctional Center in Virginia. The rising costs of supporting and visiting Eddie, including gas and overpriced items from the prison vending machine, have forced Pat to make trade-offs and sacrifices.

JPay, a private company based in Florida, has taken over handling all deposits into inmates’ accounts in Virginia, leading to increased fees for families. Sending money through JPay comes with a cost, with fees as high as 35 percent depending on the amount sent. In addition to JPay’s fees, the state deducts 15 percent for court fees and a mandatory savings account, further straining the finances of families like Pat’s.

The impact is not limited to Virginia; JPay and similar prison banking services collect tens of millions of dollars annually from inmates’ families nationwide. These fees compound the financial challenges faced by families, forcing them to make difficult choices, such as forgoing medical care, skipping utility bills, or limiting contact with their incarcerated relatives.

The investigation reveals that JPay streamlines the flow of cash into prisons, making it easier for corrections agencies to take a cut. Prisons deduct fees and charges before the money reaches an inmate’s account, and they also allow phone and commissary vendors to charge marked-up prices, with the prison collecting a share of the profits.

Critics argue that these practices contribute to the cycle of poverty and hinder the rehabilitation of inmates, making it more challenging for them to reintegrate into society upon release. Families are increasingly shouldering the financial burden, and the cost of imprisonment is shifting from taxpayers to the families of inmates.

Advocates for prison reform are calling for increased transparency, regulation, and accountability within the prison banking sector. Proposed reforms include capping fees, improving financial education programs for inmates, and fostering competition among financial institutions to ensure fair and reasonable services.

As the investigation sheds light on the exploitative practices of prison banking services, it underscores the urgent need for comprehensive prison reform to address the systemic issues affecting incarcerated individuals and their families.

![]()